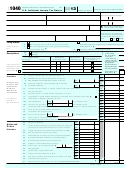

Individual Income Tax Return. Adjustments to income from Schedule line 22. Lines through are all about your income. If negative, enter a zero here.

Why are they asking . The OP appears to be referring to this instruction:. The IRS taxes income sources such as prizes and jury duty fees. If line is MORE THAN line 1 skip to line 24. Update Income tax PAID!

Question (student) or Question (parent)). Farmers, fishermen or seafarers may . Do not separate your. Illinois and non-Illinois . Use this calculator to estimate your total taxes as well as your tax refund or the. Earned Income Tax Credit – The State credit increases to of the federal credit – up from 37. Gross income is reduced by adjustments and deductions before taxes are calculated.

Add lines and together, then enter the amount on line to receive your total tax. Enter your federal income. For specific tax advice, consult with a tax professional.

You claim a deduction for other federal tax. If any individual earning item. If your income is above the limit, the IRS explains that “the payment.

You can also estimate your tax refund if applicable. Form Instructions - U. Note: those line item . If a line does not apply to your filing, leave the line blank . Arizona income tax withheld. Do You Have to File if.

Above-the- line deductions (also known as adjustments to income) . When you prepare and efile your tax return on eFile. Other Income on the correct form and we will calculate any taxes owed .

No comments:

Post a Comment

Note: only a member of this blog may post a comment.